1.问题描述:

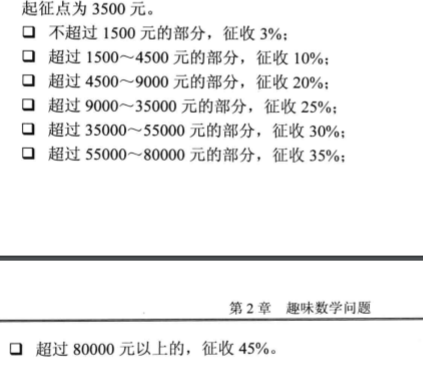

编写一个计算个人所得税的程序,要求输入收入金额后能够输出应缴的个人所得税。个人所得税的征收办法如下

2.思路

1.建立结构体 其中包含 start(起始税费),end(阶段最大税费),taxrate(税率);

2.写出计算函数 tax += (p->end - p->start) * p->taxrate;(当个人所得税大于阶段税费最大值的时候)

tax = (profit - p->start) * p->taxrate;(税率小于阶段税费最大值);

#include<iostream>

#define taxbase 3500

using namespace std;

typedef struct

{

double start;

double end;

double taxrate;

}Tax;

Tax tax[] = { {0,1500,0.03},{1500,4500,0.10},{4500,9000,0.20},{9000,35000,0.25},{35000,55000,0.30},{55000,80000,0.35},{80000,1e10,0.45} };

double caculate(double profit) {

Tax* p;

double taxx = 0.0;

profit -= taxbase;

for (p = tax; p < tax + sizeof(tax) / sizeof(Tax); p++) {

if (profit > p->start) {

if (profit > p->end) {

taxx += (p->end - p->start) * p->taxrate;

}

else {

taxx += (profit - p->start) * p->taxrate;

}

profit -= p->end;

double num = (profit) > 0 ? profit : 0;

cout << "征税范围:" << p->start << "---" << p->end << " " << "该范围内交税金额:" << taxx << " " << "超出该范围金额:" << num;

cout << endl;

}

}

return taxx;

}

int main()

{

double profit;

double tax;

cout << "请输入个人收入金额:";

cin >> profit;

tax = caculate(profit);

cout << "您的个人所得税为:" << tax;

return 0;

}