Comparing Cash-flow Streams

7.1 Equivalence

comparing two different cash flows makes sense only when they are expressed in the same time frame.

7.2 Basis for Comparison

A common frame of reference for comparing two or more

cash-flow streams in a consistent way:

- Present Worth (PW)

- Future Worth (FW)

- Annual equivalent (AE)

- Internal Rate of Return (IRR)

- Discounted Payback Period (DPP)

- Capitalized equivalent amount

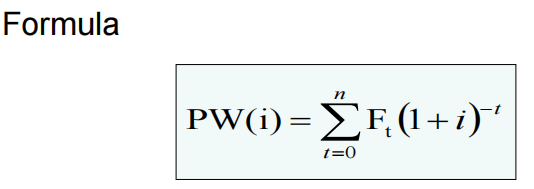

7.3 Present Worth, PW(i)

How much is the cash-flow stream worth (equivalent to) right now at interest rate, i?

Generally, as i increases PW(i) decreases.

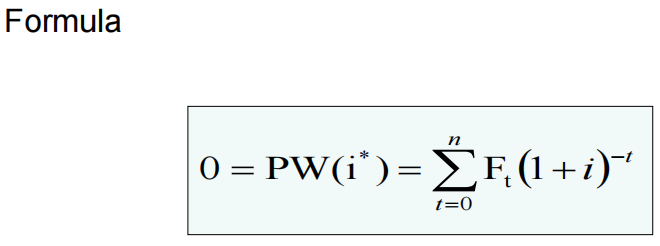

7.4 Internal Rate of Return (IRR)

To compute IRR, the cash-flow stream must have these properties:

- First non-zero cash-flow is negative.

- Followed by 0…n, further expenses with incomes from there on.

- Only one sign change in the cash-flow stream.

- The net cash-flow stream is profitable, PW(0%)>$0.

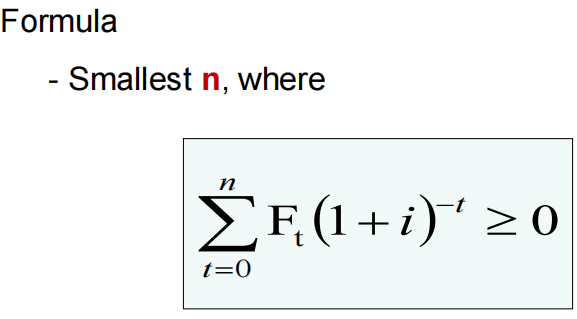

7.5 Discounted Payback Period, DPP(i)

How long to recover the investment?

7.6 Replacement Decisions

Reasons for replacement

- Deterioration(磨损)

- Obsolescence(过时)