Problem 13.1.

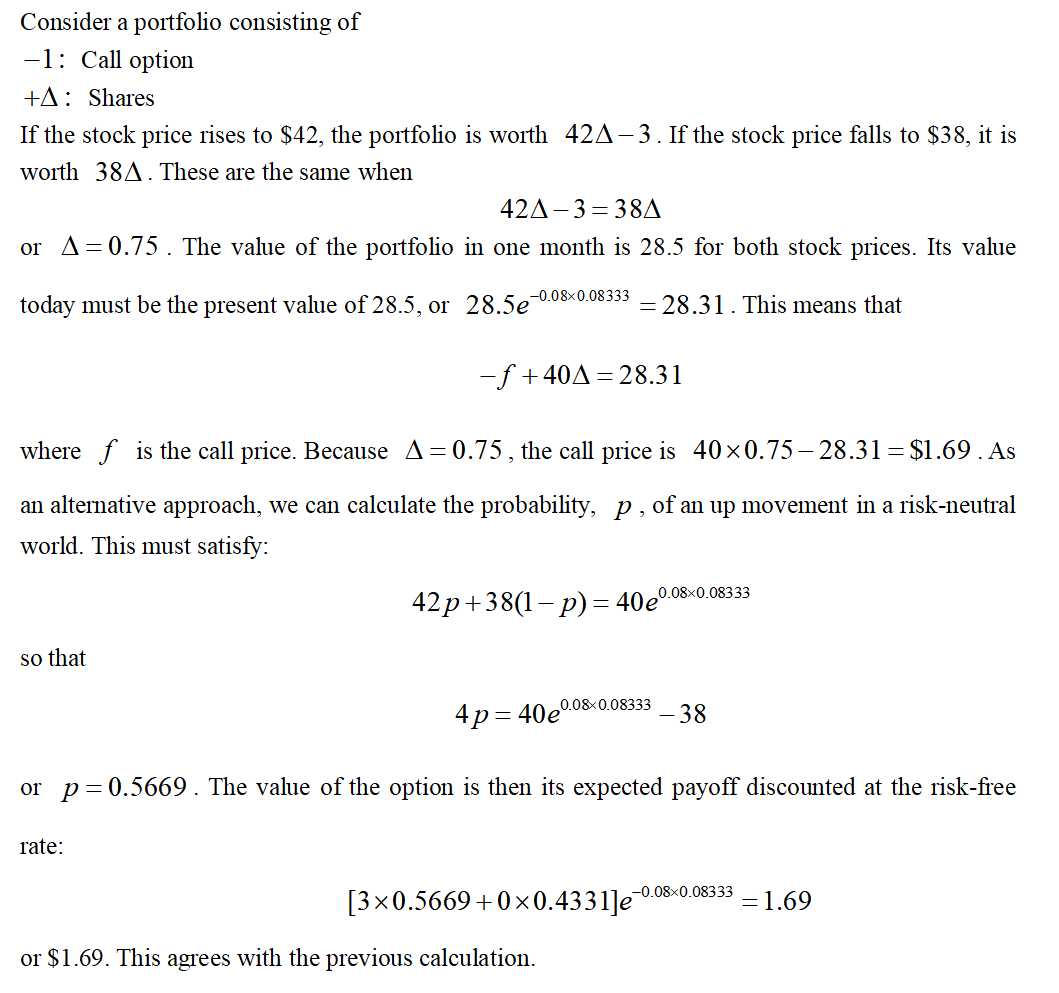

A stock price is currently $40. It is known that at the end of one month it will be either $42 or $38. The risk-free interest rate is 8% per annum with continuous compounding. What is the value of a one-month European call option with a strike price of $39?

Problem 13.4.

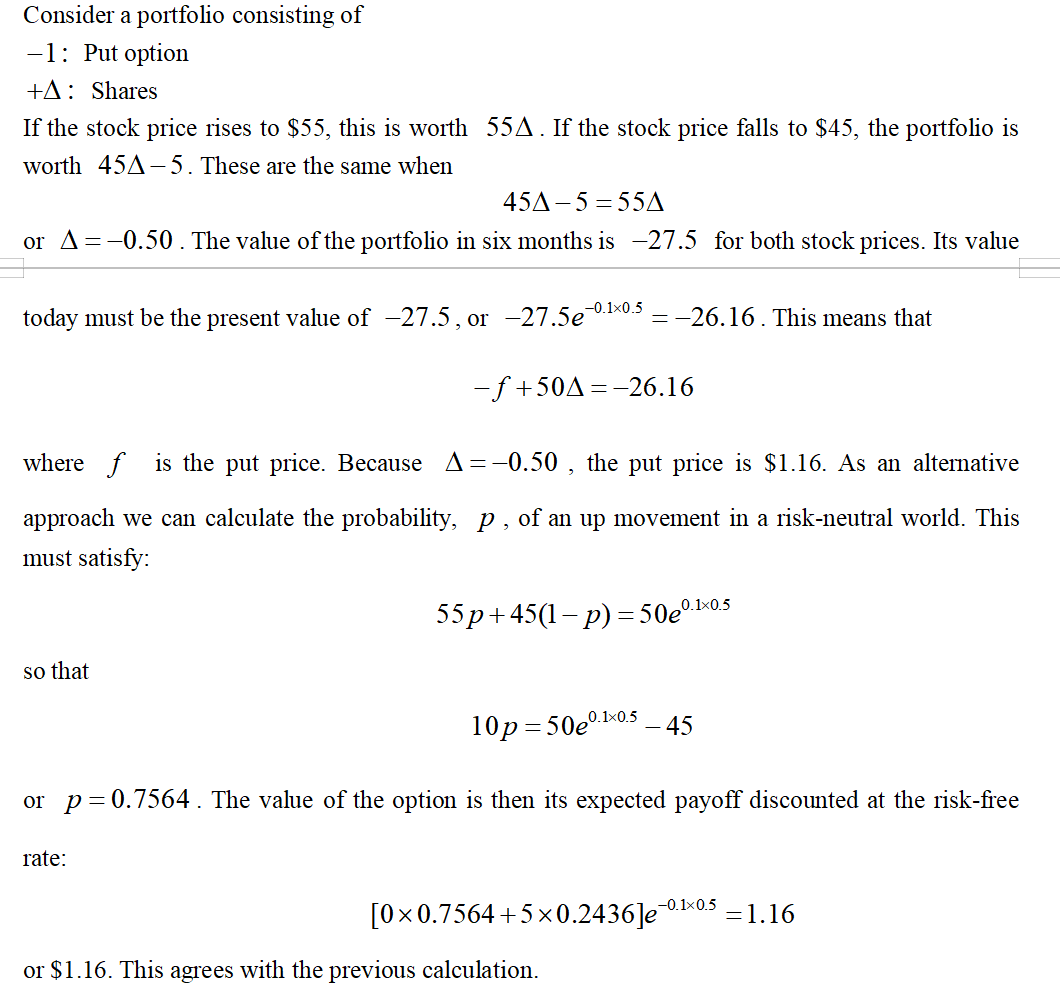

A stock price is currently $50. It is known that at the end of six months it will be either $45 or $55. The risk-free interest rate is 10% per annum with continuous compounding. What is the value of a six-month European put option with a strike price of $50?

Problem 13.5.

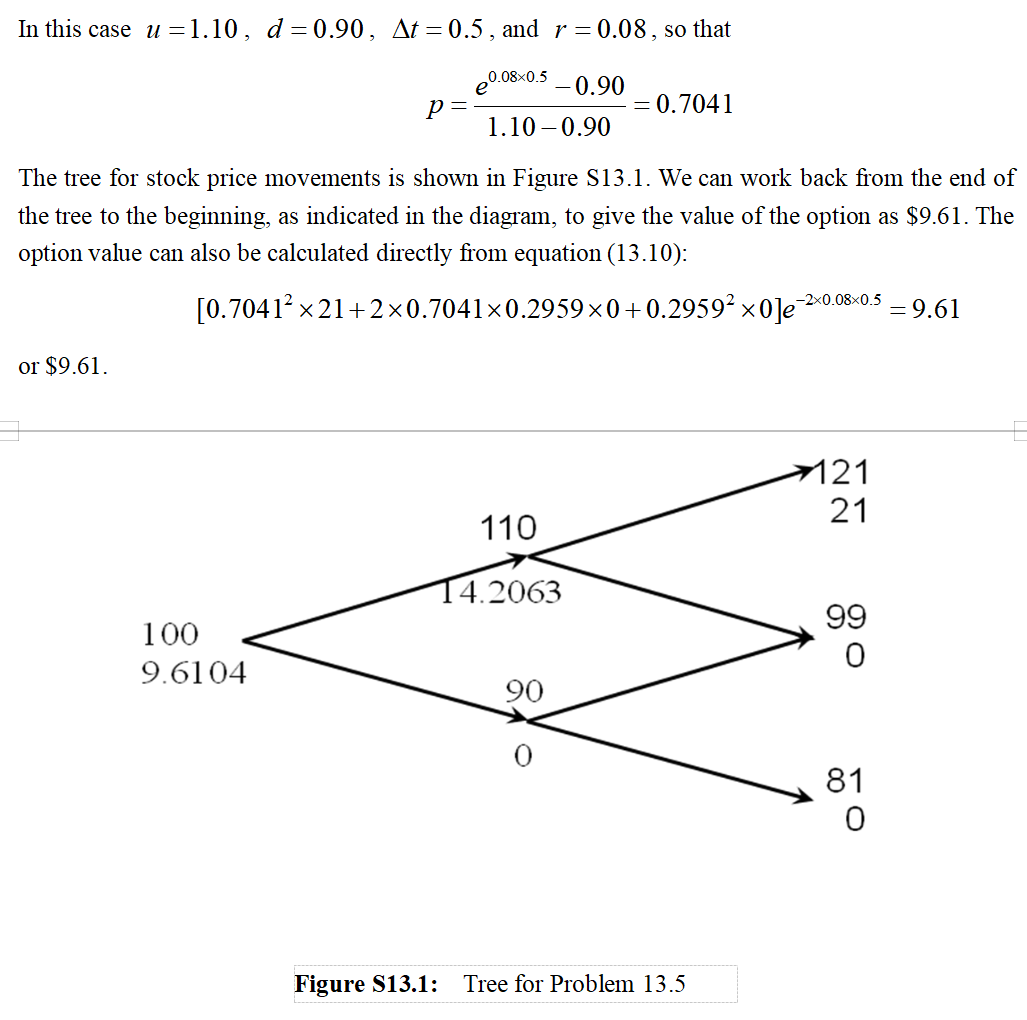

A stock price is currently $100. Over each of the next two six-month periods it is expected to go up by 10% or down by 10%. The risk-free interest rate is 8% per annum with continuous compounding. What is the value of a one-year European call option with a strike price of $100?

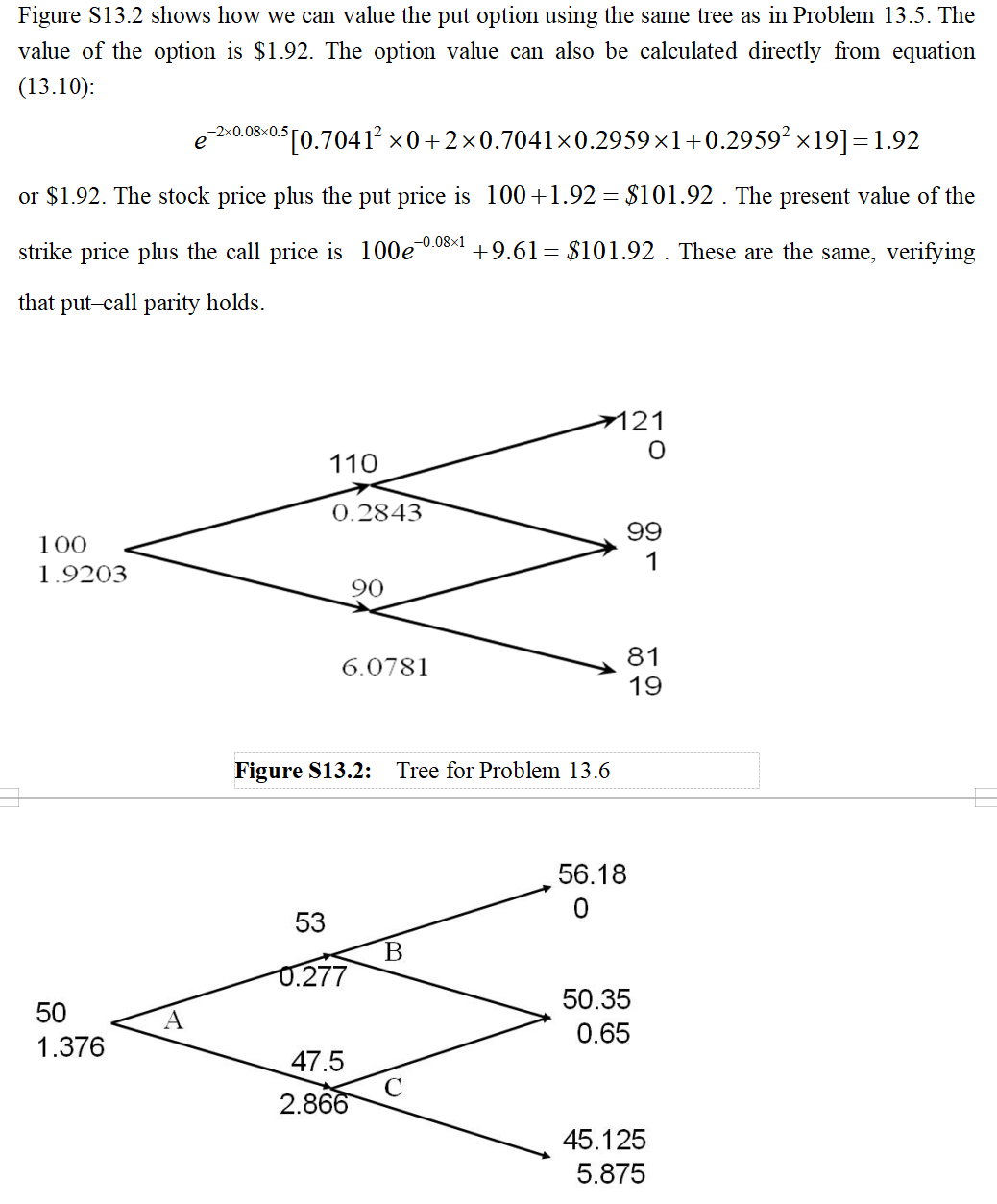

Problem 13.6.

For the situation considered in Problem 13.5, what is the value of a one-year European put option with a strike price of $100? Verify that the European call and European put prices satisfy put–call parity.

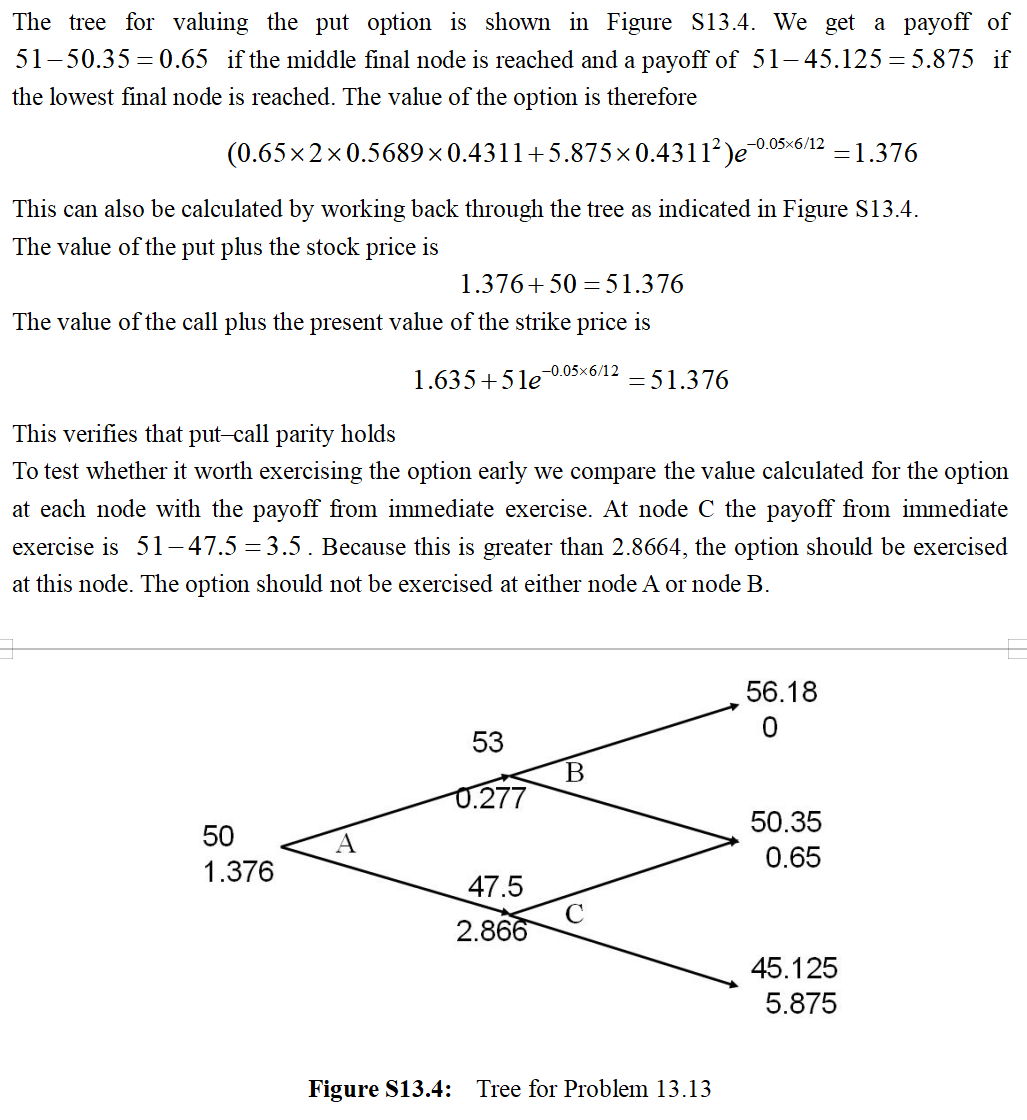

Problem 13.13.

For the situation considered in Problem 13.12, what is the value of a six-month European put option with a strike price of $51? Verify that the European call and European put prices satisfy put–call parity. If the put option were American, would it ever be optimal to exercise it early at any of the nodes on the tree?

Problem 14.2.

Can a trading rule based on the past history of a stock’s price ever produce returns that are consistently above average? Discuss.

The first point to make is that any trading strategy can, just because of good luck, produce above average returns. The key question is whether a trading strategy consistently outperforms the market when adjustments are made for risk. It is certainly possible that a trading strategy could do this. However, when enough investors know about the strategy and trade on the basis of the strategy, the profit will disappear.

As an illustration of this, consider a phenomenon known as the small firm effect. Portfolios of stocks in small firms appear to have outperformed portfolios of stocks in large firms when appropriate adjustments are made for risk. Research was published about this in the early 1980s and mutual funds were set up to take advantage of the phenomenon. There is some evidence that this has resulted in the phenomenon disappearing.

Problem 15.6.

What is implied volatility? How can it be calculated?

The implied volatility is the volatility that makes the Black–Scholes-Merton price of an option equal to its market price. The implied volatility is calculated using an iterative procedure. A simple approach is the following. Suppose we have two volatilities one too high (i.e., giving an option price greater than the market price) and the other too low (i.e., giving an option price lower than the market price). By testing the volatility that is half way between the two, we get a new too-high volatility or a new too-low volatility. If we search initially for two volatilities, one too high and the other too low we can use this procedure repeatedly to bisect the range and converge on the correct implied volatility. Other more sophisticated approaches (e.g., involving the Newton-Raphson procedure) are used in practice.

Problem 15.7.

A stock price is currently $40. Assume that the expected return from the stock is 15% and its volatility is 25%. What is the probability distribution for the rate of return (with continuous compounding) earned over a two-year period?

Problem 15.8.

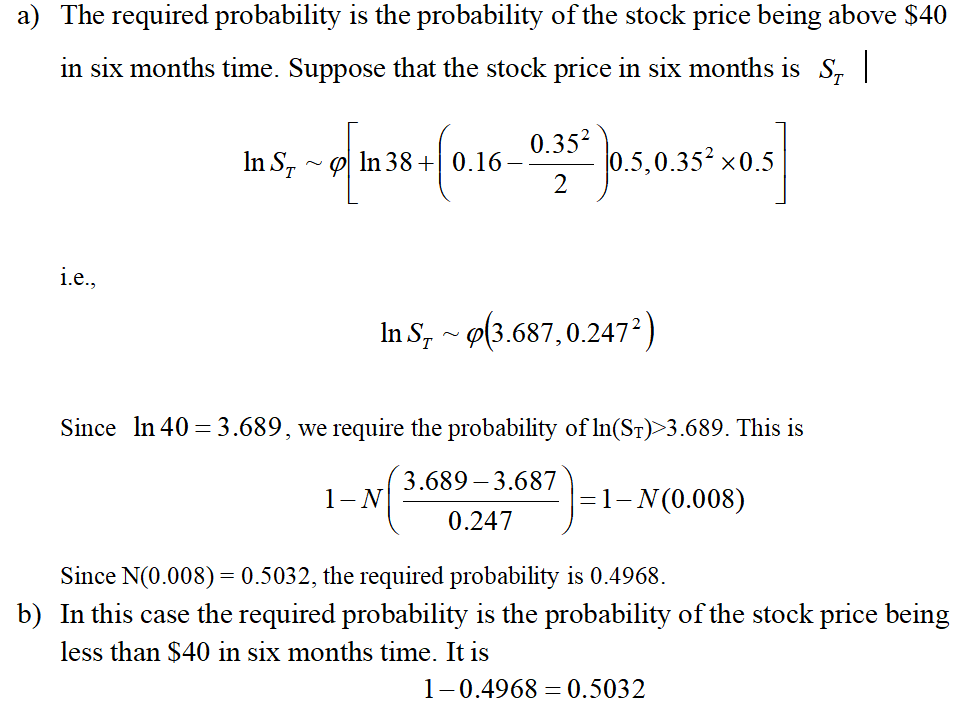

A stock price follows geometric Brownian motion with an expected return of 16% and a volatility of 35%. The current price is $38.

What is the probability that a European call option on the stock with an exercise price of $40 and a maturity date in six months will be exercised?

What is the probability that a European put option on the stock with the same exercise price and maturity will be exercised?