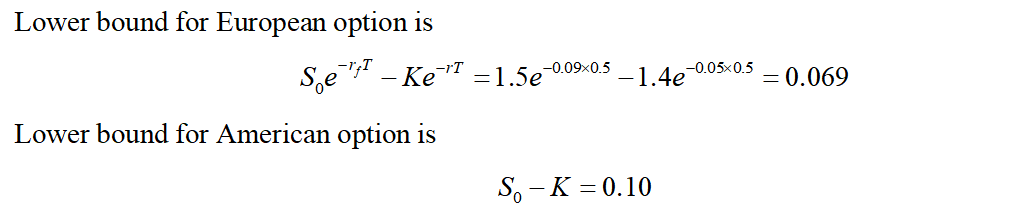

Problem 17.9.

A foreign currency is currently worth $1.50. The domestic and foreign risk-free interest rates are 5% and 9%, respectively. Calculate a lower bound for the value of a six-month call option on the currency with a strike price of $1.40 if it is (a) European and (b) American.

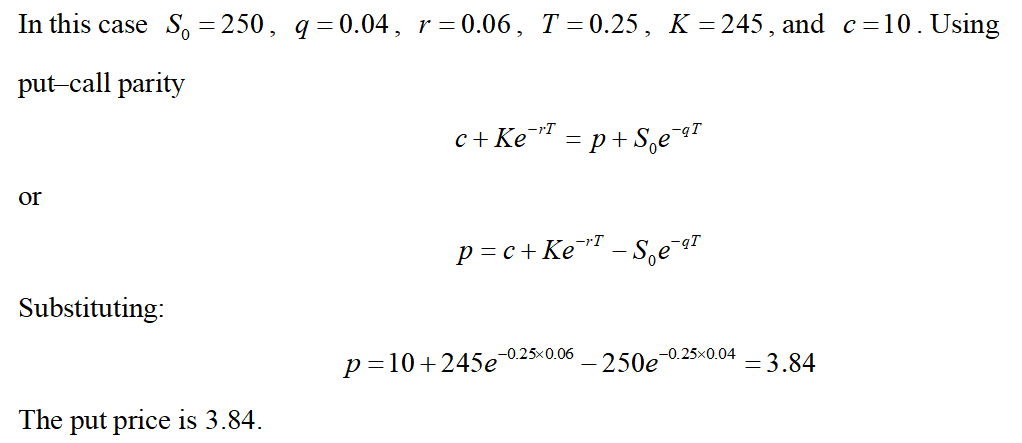

Problem 17.10.

Consider a stock index currently standing at 250. The dividend yield on the index is 4% per annum, and the risk-free rate is 6% per annum. A three-month European call option on the index with a strike price of 245 is currently worth $10. What is the value of a three-month put option on the index with a strike price of 245?

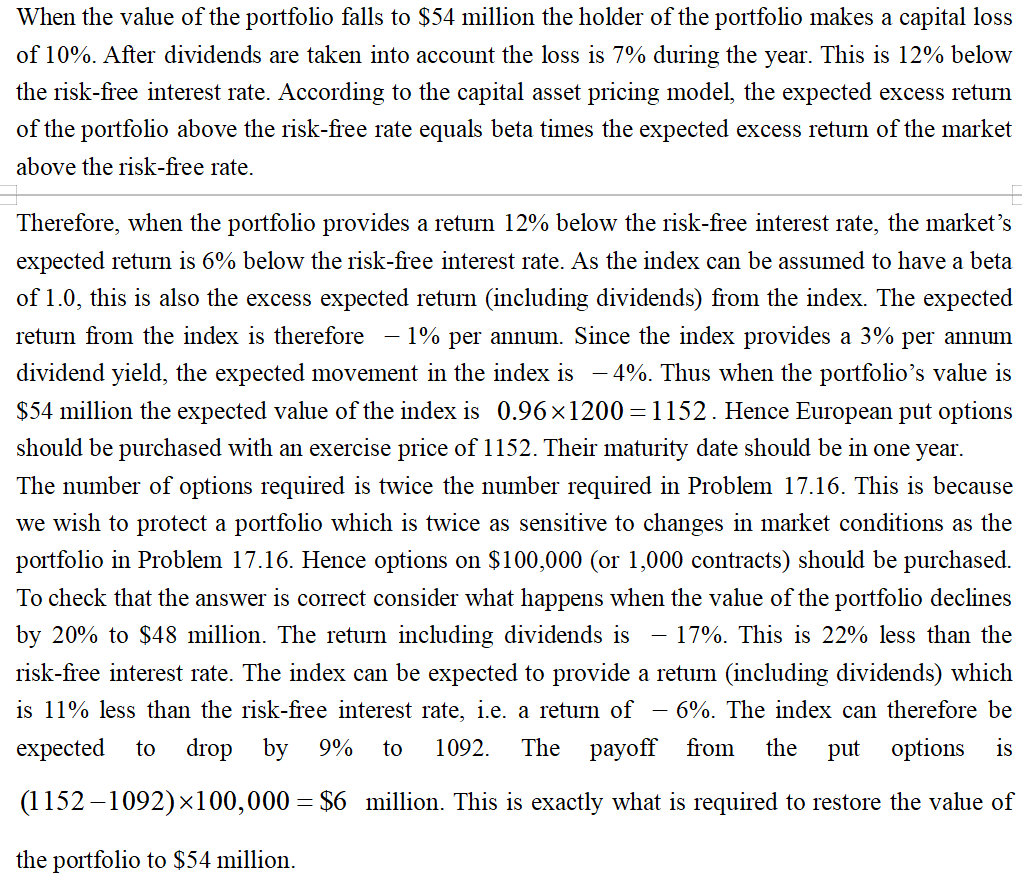

Problem 17.17.

Consider again the situation in Problem 17.16. Suppose that the portfolio has a beta of 2.0, the risk-free interest rate is 5% per annum, and the dividend yield on both the portfolio and the index is 3% per annum. What options should be purchased to provide protection against the value of the portfolio falling below $54 million in one year’s time?

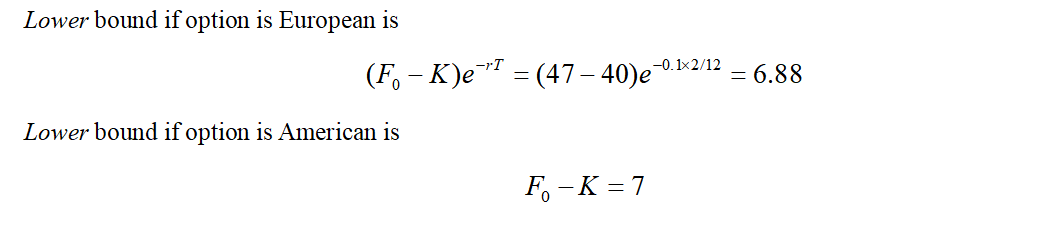

Problem 18.10.

Consider a two-month futures call option with a strike price of 40 when the risk-free interest rate is 10% per annum. The current futures price is 47. What is a lower bound for the value of the futures option if it is (a) European and (b) American?

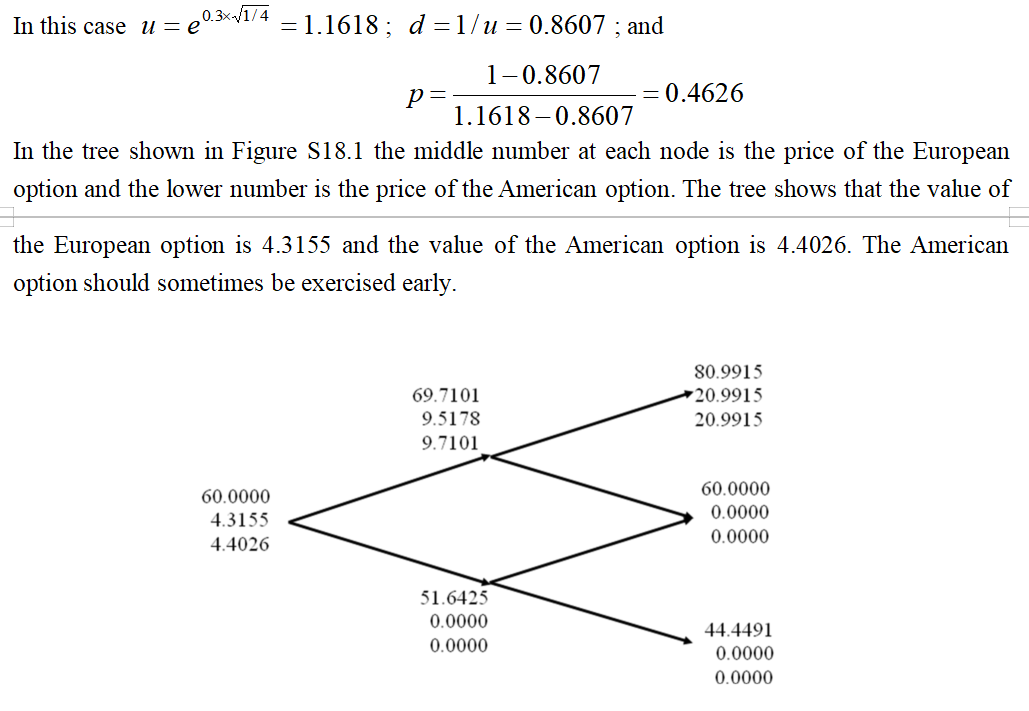

Problem 18.12.

A futures price is currently 60 and its volatility is 30%. The risk-free interest rate is 8% per annum. Use a two-step binomial tree to calculate the value of a six-month European call option on the futures with a strike price of 60? If the call were American, would it ever be worth exercising it early?

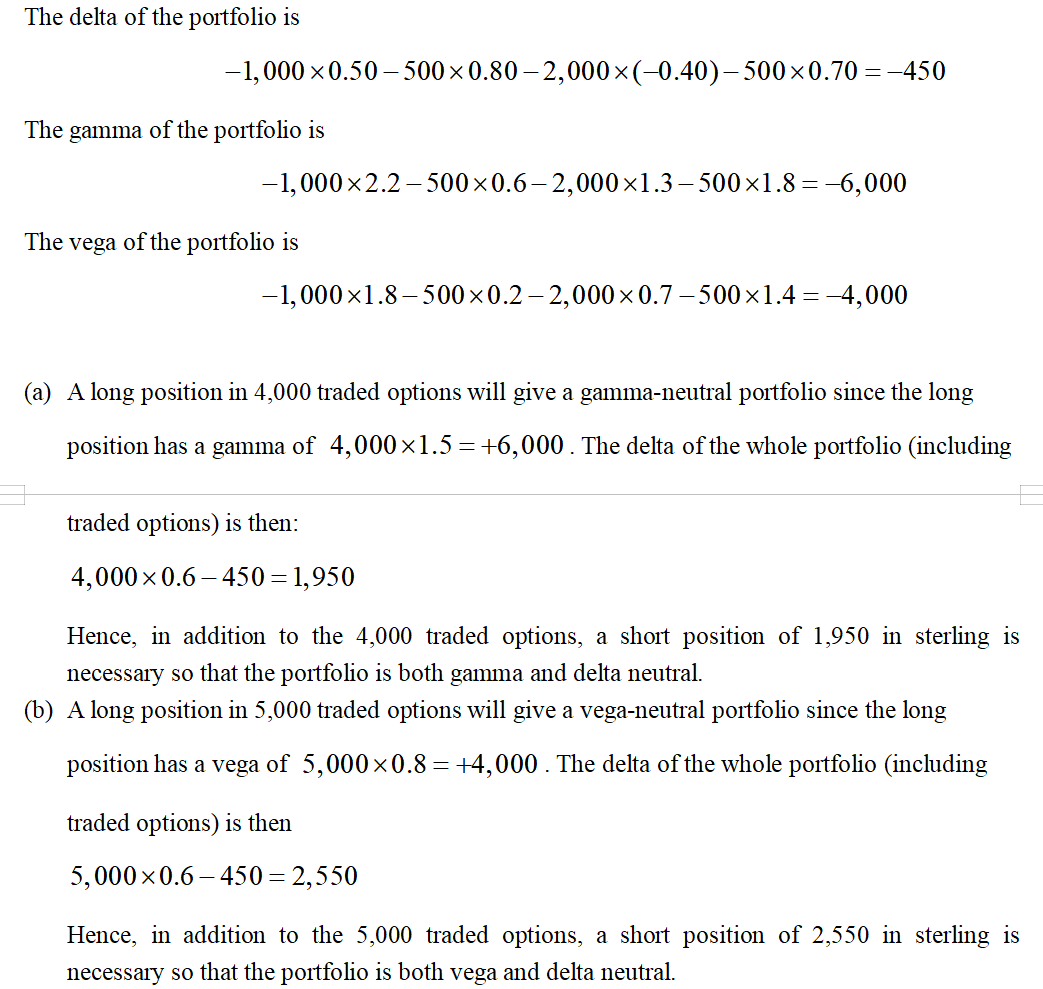

Problem 19.24.

A financial institution has the following portfolio of over-the-counter options on sterling:

|

Type |

Position |

Delta of Option |

Gamma of Option |

Vega of Option |

|

Call |

−1,000 |

0.5 |

2.2 |

1.8 |

|

Call |

−500 |

0.8 |

0.6 |

0.2 |

|

Put |

−2,000 |

-0.40 |

1.3 |

0.7 |

|

Call |

−500 |

0.70 |

1.8 |

1.4 |

A traded option is available with a delta of 0.6, a gamma of 1.5, and a vega of 0.8.

(a)What position in the traded option and in sterling would make the portfolio both gamma neutral and delta neutral?

(b)What position in the traded option and in sterling would make the portfolio both vega neutral and delta neutral? Assume that all implied volatilities change by the same amount so that vegas can be aggregated.

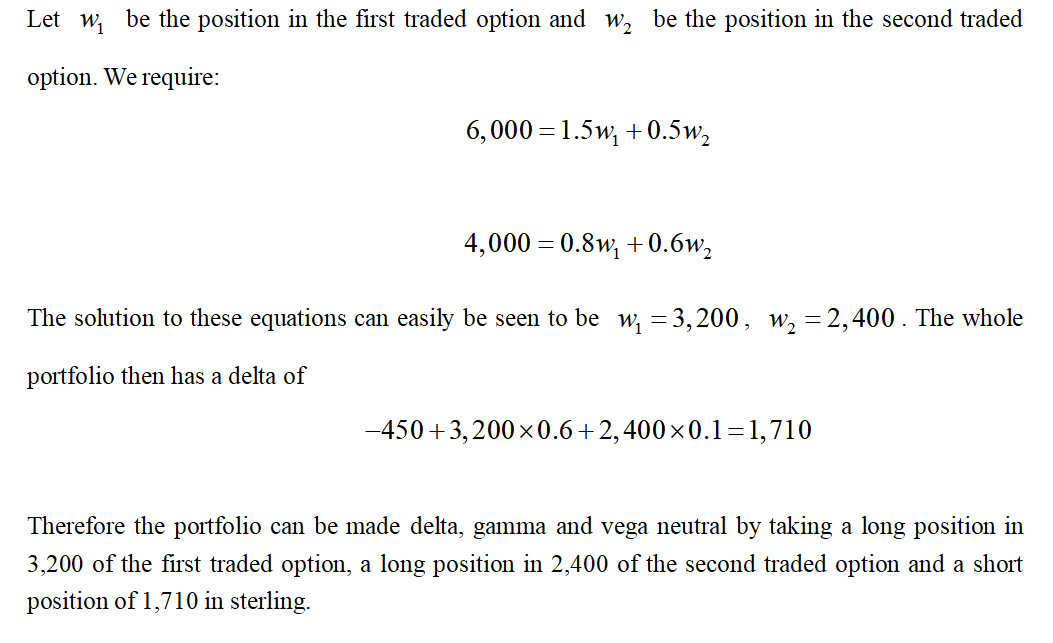

Problem 19.25.

Consider again the situation in Problem 19.24. Suppose that a second traded option with a delta of 0.1, a gamma of 0.5, and a vega of 0.6 is available. How could the portfolio be made delta, gamma, and vega neutral?

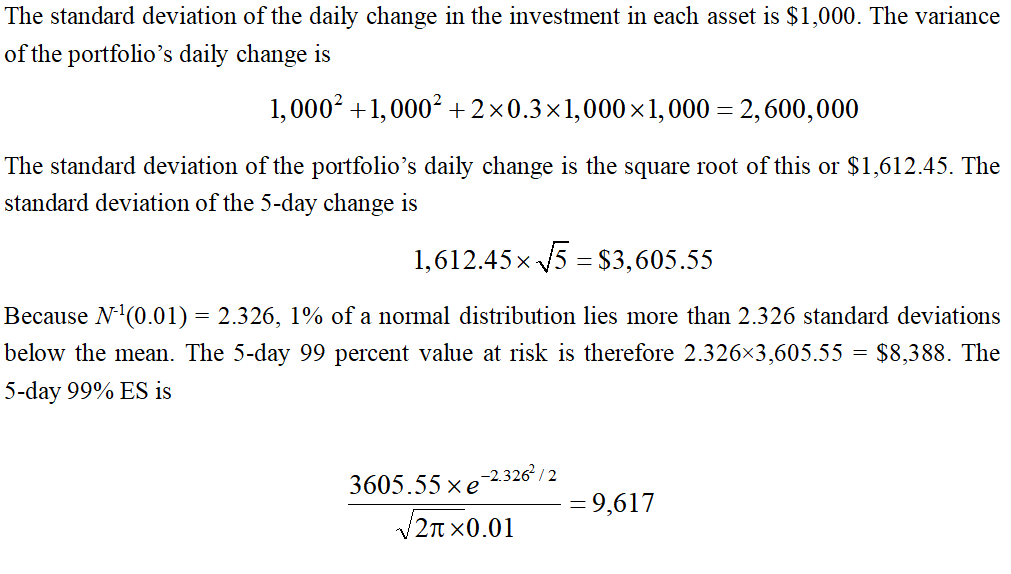

Problem 22.1.

Consider a position consisting of a $100,000 investment in asset A and a $100,000 investment in asset B. Assume that the daily volatilities of both assets are 1% and that the coefficient of correlation between their returns is 0.3. Estimate the 5-day 99% VaR and ES for the portfolio assuming normally distributed returns.